7 options for better interest than a current account

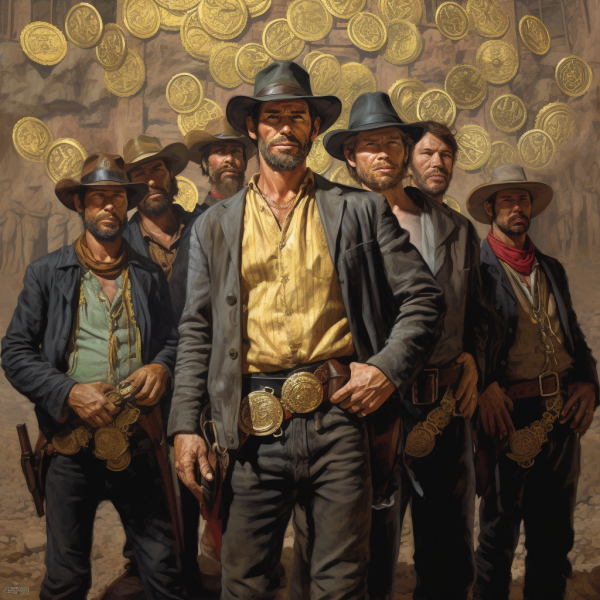

Everyone has seen the Seven Brave Ones. But do you know 7 conservative ways to help your savings fight inflation with little or no risk?

However, the current period of high interest rates, which are probably nearing their peak, is particularly beneficial for funds investing in government and other bonds. Today, you can ensure solid appreciation for years to come. We can go through the variety of different funds together.

Savings account

+ You can have your money quickly at hand and at a higher interest rate than in a current account.

- Rates will fall as soon as the CNB starts to cut rates.

Time deposit

+ Higher interest than a savings account for the entire term of the deposit, which is insured.

- You cannot withdraw money at will for a set period of time.

Credit unions and bank credit unions

+ Higher interest than banks.

- A portion of the deposit (10%) is not insured and has no guaranteed appreciation.

Repo Funds

+ Low-risk investments replicating the rates set by the CNB, possibility to appreciate foreign currencies.

- Interest rates will fall as the CNB lowers them.

Funds investing in Czech government bonds

+ Low risk and higher investment appreciation when the CNB starts to lower interest rates.

- The investment should have a horizon of a few years.

Government and corporate bond funds

+ Higher yield and expected higher appreciation of the investment as the CNB lowers interest rates.

- Slightly higher risk that the value of the investment will fluctuate, so it is advisable to invest for a longer period.

Real estate funds

+ An alternative to investing in physical property that you can convert back into cash much more quickly and you don't need a mortgage on it.

- If property prices fall or tenants struggle to make repayments, the value of the fund may fall.

This is just a fraction of all the options the investment world has to offer, which can be skilfully combined and complemented. If you want to invest for the longer term, there are a wealth of options in equity funds or physical gold investments, for example. We'll be happy to go through them with you and help you choose solutions that really make sense for you, even taking into account your options, life plans and goals.

Edward Deposit Account

You may have caught the news in the media that the CNB Bank Board increased the two-week repo rate (2T repo rate) by 1.25 percentage points to 7% on June 23, 2022. With this increase, Edward's deposit account yields 6.25% per annum!

More